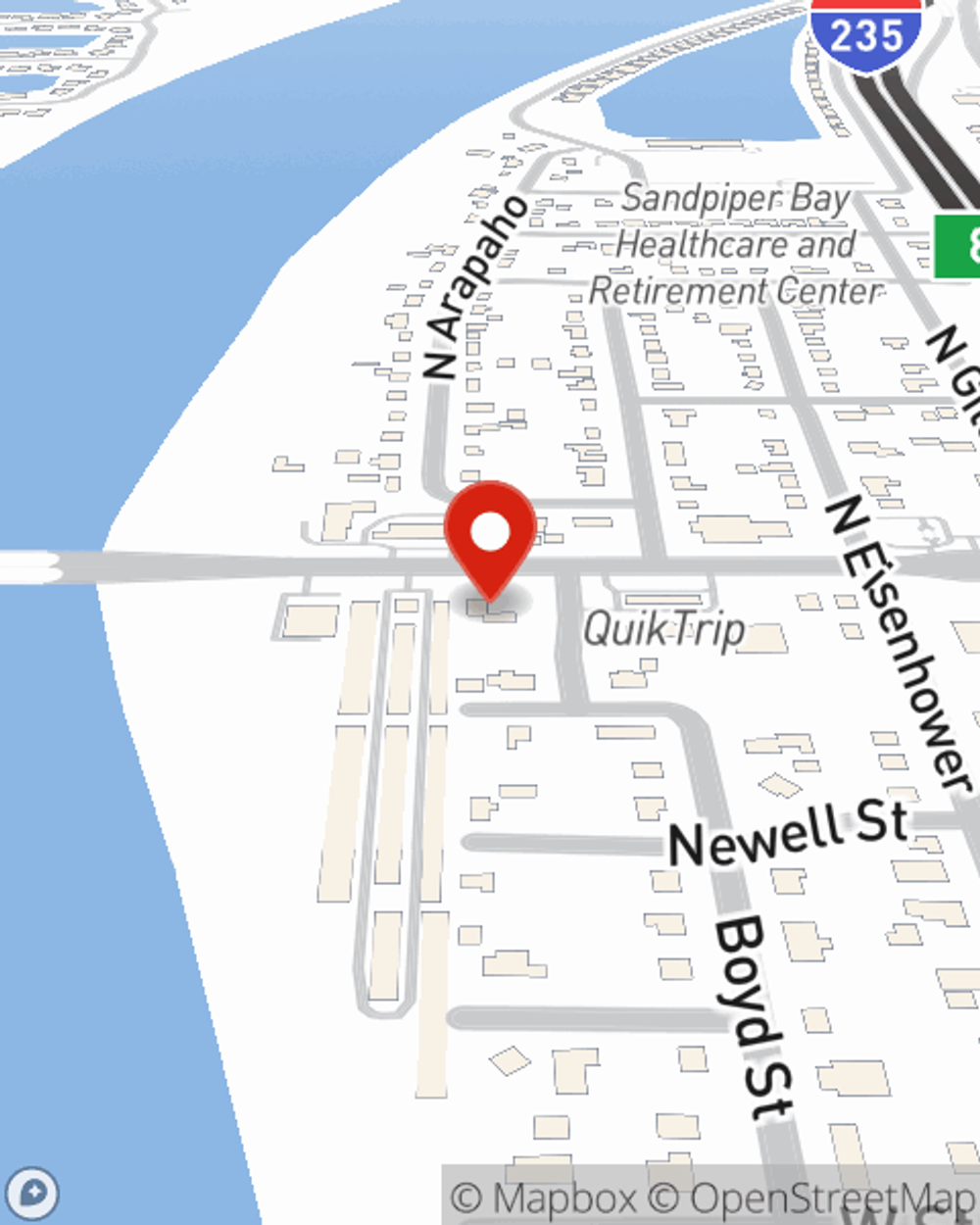

Business Insurance in and around Wichita

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

- Maize

- Valley Center

- Park City

- Bel Aire

- Goddard

- Derby

- Andover

- El Dorado

- Newton

- Heston

- Hebron, NE

- York, NE

- Scottsbluff, NE

- Oklahoma City

- Tulsa

Insure The Business You've Built.

Running a business can be risky. It's always better to be prepared for the unfortunate problem, like a staff member getting hurt on your business's property.

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

Strictly Business With State Farm

No one knows what tomorrow will bring—especially in the business world. Since even your most detailed plans can't predict consumer demand or product availability. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for protection with a State Farm small business policy. Business insurance is necessary for many reasons. It protects your future with coverage like business continuity plans and errors and omissions liability. Terrific coverage like this is why Wichita business owners choose State Farm insurance. State Farm agent Caleb Hanke can help design a policy for the level of coverage you have in mind. If troubles find you, Caleb Hanke can be there to help you file your claim and help your business life go right again.

Do what's right for your business, your employees, and your customers by visiting State Farm agent Caleb Hanke today to discover your business insurance options!

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Caleb Hanke

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.